While there are literally hundreds of accounting reports that can help you run your business better, one of the most popular – and greatly underutilized – reports is the variance report. A variance report helps you compare how you are actually doing with either a past or expected performance. It makes it crystal clear how far you’re straying from where you want to be so that you can make course corrections earlier rather than later.

Variance to Prior Periods

A common variance report that almost anyone can generate is one that compares current period results to prior period results. For example, you can generate an income statement with six columns:

- Current month activity, such as March 1 to March 31, 2022

- Prior year month activity, such as March 1 to March 31, 2021

- Month difference or variance (A – B)

- Year-to-date activity, such as January 1 to March 31, 2022

- Prior-year-to-date activity, such as January 1 to March 31, 2021

- Year-to-date difference or variance (D – E)

The variance allows you to see, at a glance, whether your sales or expenses have increased compared to last year. Seeing monthly variances is especially important if the business experiences seasonal fluctuations.

You can go one step further to explain the variances in an accounting process called account analysis. Take a look at the components of each number to see what caused the variance. Write your explanation in a notes section of your variance report.

You may not want to spend management time on the small variances. A good financial dashboard, or simply an Excel spreadsheet, can help you color-code the balances that are more than 10 percent (or any percent you feel is material) off track.

Variance to Plan or Budget

You can also develop a variance report that compares current period results to budget. Here, you would generate an income statement with these six columns:

- Current month actual activity, such as March 1 to March 31, 2022

- Budget for the same period above

- Month difference or variance or (over)/under (B – A)

- Year-to-date actual activity, such as January 1 to March 31, 2022

- Year-to-date budget, such as January 1 to March 31, 2021

- Year-to-date difference or variance or (over)/under (E – D)

Do the same thing above, color-coding and explaining the variances using account analysis. How did your budget details differ from what actually happened? If it’s better, can you do more? If it’s worse, how can you get back on track? Performing a timely variance analysis helps you find opportunities to exploit so you can make more money or investigate ways to get back on track faster so you don’t lose as much.

Of course, with budget versus actual variance reports, you do have to create the budget first!

If you’re not already receiving variance reports, would like help creating a budget, or would simply like to set up a session to better understand variances, please feel free to reach out any time.

You’re not alone if you’re having trouble attracting and keeping staff. A convergence of issues has created one of the greatest talent shortages in our lifetimes. With boomers retiring in large numbers, pandemic and opioid deaths, people not wanting to work for low wages, child care availability disappearing, tighter immigration policies, people rethinking their life choices, and so many other factors, it’s no wonder small businesses are having trouble finding workers.

The good news is small business owners still have a lot in their control to be able to attract the perfect candidate to our workplaces. Here are some ideas to help you do just that.

- Be open to multiple options when it comes to what an employee looks like

If you require a 40-hours-a-week, onsite worker who has to dress in formal clothes to come to work, you need to rethink everything. Many talented people are choosing to work part time, and it might just be easier to find two part-time workers instead of one full-time employee.

How much of the job can they do virtually? This opens up your hiring pool nationally and perhaps even internationally. Consider also temporary versus permanent. And consider outsourcing certain functions as well.

The key is to be open to creative ways to get the job done.

- Make fun a vital part of your workplace

Even if there are numerous deadlines and serious work to be done, your workplace can still be fun. A good start is bringing food to work; camaraderie always blossoms around food.

Add in extra activities like movie or games night, take weekly team lunches, start an amateur sports team, or encourage co-worker get-togethers after work. Decorate the office for each holiday, and celebrate birthdays, anniversaries, and employee successes. Create fun projects such as a volunteer day for a local charity, or support a team entry at a local fun run.

In short, create a culture where employees can not only have fun, but be themselves.

- Add perks, and not just the usual suspects

Employees are demanding more of their employers, and the best businesses are listening and delivering. Beyond increased pay and the usual benefits – 401K, health insurance, vacation, and PTO – here are some new additions:

- Flex hours – more say in when they work

- Work-at-home days – more people are working at home at least part of the time

- Pet insurance – a New England CPA firm offers this to workers now

- Extra PTO – one marketing agency in Texas provides unlimited PTO, no questions asked

- Child care – any way to make this easy on parents is a plus

Other perks to think about are holiday gifts, bonuses, free dry cleaning, free car washes, and employee discounts.

- Embrace technology

Employees want the best tools you can give them so they can do a good job. Be sure your employees are fitted with the latest hardware and software so there is less stress around the inevitable tech glitches that occur. There’s nothing worse than having a deadline and coming across a software glitch that wastes precious time.

- Apply marketing techniques to hiring

Instead of posting the old boring job ad, create a campaign to find employees. Make sure your social media is up to date and mirrors the fun culture of your organization. Be sure to look in places you may not have traditionally looked for candidates. Create a job interview process that’s interesting and enthusiastic. You’re definitely competing for talent, so doing all of these things will help you win.

We may be in a period of staff shortages, but there are still millions of people who want to work. Do just a little more for your employees and candidates than the small business down the street, and they will want to keep working for you.

The last few years have been unlike any other in our lifetimes. As we close out 2021 and enter 2022, it’s the perfect time to reflect on what we’ve learned, what’s happening now, and what we want to accomplish in the next 12 months. Here are some things to consider.

Celebrate Your Successes

Give yourself time and permission to review what you have completed in 2021. You’ve likely learned and accomplished more than you think. Compare your status on January 1, 2021 with today, and celebrate the changes you’ve made and projects you’ve finished.

Monetize These Trends

Several trends will continue from 2021 into 2022 and beyond. How can you monetize them in your business?

- The move to remote work is likely to continue, especially in certain industries, such as financial services and technology, where the work is delivered digitally. Hiring virtual workers gives employers access to a larger talent pool as well.

- Expanding your online presence, including ecommerce, is paramount. Most businesses spent more time improving the online interface between company and customers as more customers clamored for increased online purchasing, delivery, and curbside pickup. Some brick-and-mortar businesses adapted their business model to develop new digital services, enhancing their current product line.

- Climate changes affected many businesses this year in at least two different ways. Some were victims of disasters via extreme weather. Others became more visibly supportive of climate initiatives, working these initiatives into their mission and offerings.

- Accelerated automation using artificial intelligence is continuing to move through the technology adoption curve. Can your business benefit from AI-driven tech solutions?

- Diversity initiatives will continue to be important in 2022 and beyond.

- Workforce demographics are finally changing. More young people are working in 2021 compared to pre-pandemic numbers, while workers over 50 are retiring at a faster-than-normal rate. Millennials are starting businesses in large numbers, and one statistic shows that 80 percent of those businesses are profitable.

- Staffing struggles are real in many industries. Many business owners who can no longer find employees have had to resort to outsourcing, contract, part-time, virtual, and many other capacity options to keep their businesses afloat.

- Social responsibility has been prioritized by Millennials and members of Gen Z, making business owners ask how they can do their part in their businesses.

- Life-goal realignment is something that has swept the world as people experience a wake-up call because of the pandemic. The search for purpose and meaning is one of many side effects of this trend. Ask yourself how this trend is affecting your customers and employees.

Set 2022 Goals

Let’s not call them New Year’s resolutions, shall we? Still, it’s the right time of year to decide how you can incorporate the trends above with the personal and business successes you’d like to complete by the end of 2022.

Make your list, then schedule milestones on your calendar so you can track your progress.

And above all, have a happy New Year in 2022.

How effective is your sales function in your business? One way to answer that question at a deep level is to calculate conversion metrics for every step of your sales cycle. These numbers are not tied to any numbers on your balance sheet or income statement, but can help you realize a better return on your sales and marketing expenses.

Your Sales Cycle

The sales process is different for every business. If the dollar amount of the customer purchase is small, the sales cycle needs to be very short or it won’t be efficient. For larger purchases, the sales cycle might be longer.

The first step in determining conversion metrics is to outline the steps a typical prospect takes before they become a customer. Here are a few examples:

Retail example.

- Prospect walks into store.

- Sales clerk interacts.

- Prospect selects item(s).

- If clothing, they may visit a dressing room and try it on.

- Prospect stands in checkout line.

- Customer completes purchase.

Ecommerce example.

- Prospect visits website and uses search or navigation.

- Prospect views lists of products.

- Prospect views product page.

- Prospect places product in cart.

- Customer completes checkout.

Service example.

- Prospect sends email requesting more info or an appointment.

- Customer service/sales clerk responds to email.

- Prospect makes appointment.

- Salesperson and prospect meet.

- Sales person perform follow-up activities.

- Prospect agrees to price/purchase.

- Client signs contract and pays initial deposit.

For each step in the processes above, the prospect can fail to proceed to the next step. Conversion is measured at each step with the percentage of prospects that proceed to the next step.

Not all steps are worth measuring. Sales and marketing personnel must agree on when a prospect becomes a viable lead. Measurements should occur from lead to customer.

Let’s expand on the service example.

- Prospect sends email requesting more info or an appointment.

- Customer service/sales clerk responds to email.

- Prospect makes appointment.

The first meaningful conversion can be calculated between steps one and three. Let’s say in the month of November, the company received 100 emails from prospects requesting more info and 50 made appointments. The conversion rate is calculated as follows:

# Appointments made (step 3) / # prospect emails received (step 1) = 50/100 = 50%

To improve the 50 percent conversion rate, ask yourself what can be done between steps one and three to improve the prospect-facing activities.

Here’s another example:

- Salesperson and prospect meet.

- Salesperson performs follow-up activities.

- Prospect agrees to price/purchase.

- Client signs contract and pays initial deposit.

The second meaningful conversion rate in the service sales process can be calculated between steps four and seven. (You could also measure 3-4, 4-6 and 6-7.) Let’s say 40 appointments were kept and 30 became clients.

# New clients signed (step 7) / # salesperson and prospect meet (step 4) = 30/40 = 75%

To improve the 75 percent, ask yourself what you can do in steps four through seven to improve the prospect’s experience.

Actionable Sales Intelligence

As you measure these results over time, are you improving or declining for each conversion? Is one salesperson closing more business than any of the others? How can you improve each step so that conversion is increased? You will have more questions than answers when you first start calculating these numbers. You will also likely have many “aha” moments of insight you can use to improve the prospect’s journey.

If conversion is extremely low in the first few steps, it could be that marketing is not sending you qualified leads. In that case, marketing needs to improve before conversion can improve. If conversion is low in the final few steps, follow-up activities may need to be strengthened.

In any case, measuring conversion throughout your sales cycle will pinpoint the weakest areas so you can improve. When you can increase your conversions, your marketing and sales costs will decrease, and you will become more effective.

And if we can help you with any of these measurements, please reach out any time.

Keeping track of how you and your workers spend time is one of the most important things you can do in your business. Labor costs can be a large portion of expenses, and understanding how time is spent can help you manage your business better in a multitude of ways.

Benefits of Time Tracking

There are many reasons and benefits to track time:

- If you price by the hour, time tracking is mandatory, because without it, you won’t be able to invoice your clients accurately.

- Tracking time helps managers understand how long a task should take, where employees may need training, and where processes and procedures may need improving.

- Information on time reports can be fed into a project management system and reviewed to make better fixed fee pricing estimates on future jobs and customer proposals.

- Time tracking feeds into job costing for construction companies.

- For manufacturing businesses, time tracking feeds into labor reports.

- Time tracking is used in payroll systems to pay hourly workers accurately.

- Time tracking can increase accountability among workers as they become more aware of how they spend their working time.

- When time is budgeted in advance, actual hours worked can be compared to see how the budget is used and whether it was too much or too little.

- Time tracking allows managers and business owners to determine when they need to hire additional staff because the backlog has become too large.

What Is Time Tracking?

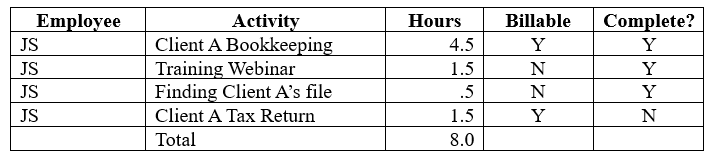

Time tracking is the recording of how you spend your time. You can use paper, a spreadsheet, or time tracking software to log the task you are working on and the length of time you worked on it. For example, here’s a simplistic example of a time log, or timesheet, for one day:

Employees may be required to complete timesheets on a daily or weekly basis, which are then turned into their managers and payroll administrators.

Managers can take time tracking to the next level by adding hourly payroll costs as well as the employee’s hourly billing rate to gain insight into further time-tracking financial metrics.

Time Tracking Software

There are many different types of time-tracking software:

- A time clock allows employees to “punch in” when they arrive for work and “punch out” when they leave. This type of machine is mostly used for payroll in a manufacturing setting.

- Time tracking applications allow workers with computers to enter their time via the application. In some cases, workers can enter their time via a mobile device.

- Some companies will have their time tracking function embedded into their project management, job costing, or billing system. Employees would then enter their time via those applications.

Getting Employees on Board with Time Tracking

Reporting your hours in a time-tracking system is one of the least favorite tasks of employees and requires an education in mindset and attitude more than any software instructions. It’s important that your employees do not feel like you will be “Big Brother” when it comes to using their time data.

For best results, let employees know how the timesheet data will be used. Allay their fears that they will not get fired or in trouble if they feel something “took too long,” which can often translate into an employee “fudging” their hours on a task where they might have made a mistake. Make sure they know they won’t be penalized in any way for what they report.

Communication is key in getting employees to report their time accurately so that managers and owners can receive meaningful information. Have managers tie time tracking to an employee’s personal career goals to increase adoption and reduce resistance.

Personal Time Tracking

Time is our most precious commodity, and tracking your personal time can give you insights into how you are investing in yourself. Some really interesting questions can be considered when you have some time data for yourself.

- How much “downtime” do you need each day?

- How much time are you spending on your life goals?

- Are you spending time on what you consider to be important?

Getting Started with Time Tracking

If you’re considering time tracking or would like to take your current time-tracking function to the next level, please reach out. We may be able to help with integration, implementation, the accounting aspect of time-tracking, and financial metrics and reports.

Alisa A. Mitchell CPA PA

Alisa A. Mitchell CPA PA